Brief Summary

This video provides a step-by-step guide to solving accounting problems with incomplete records. It covers the essential formats, the creation of necessary accounts, and the step-by-step approach to completing the records. The video uses a practical example to illustrate the process, including how to handle receipts, payments, and adjustments.

- Focuses on completing incomplete accounting records.

- Explains the formats for trading, profit and loss, and balance sheet accounts.

- Details the creation and use of accounts like Bills Receivable, Debtors, Bills Payable and Creditors.

- Provides a step-by-step approach to solving problems, including initial balance sheet adjustments, receipt and payment postings, and final account closures.

Introduction to Incomplete Records

The video introduces the concept of accounting with incomplete records, where the task is to complete a set of accounts that are not fully maintained. The presenter explains that although the topic might seem complicated, it involves finalising accounts, including trading accounts, profit and loss accounts, and balance sheets, similar to what is taught in the 12th standard. The key is to take the incomplete information and fill in the missing pieces to complete the financial picture.

Understanding the Question and Required Formats

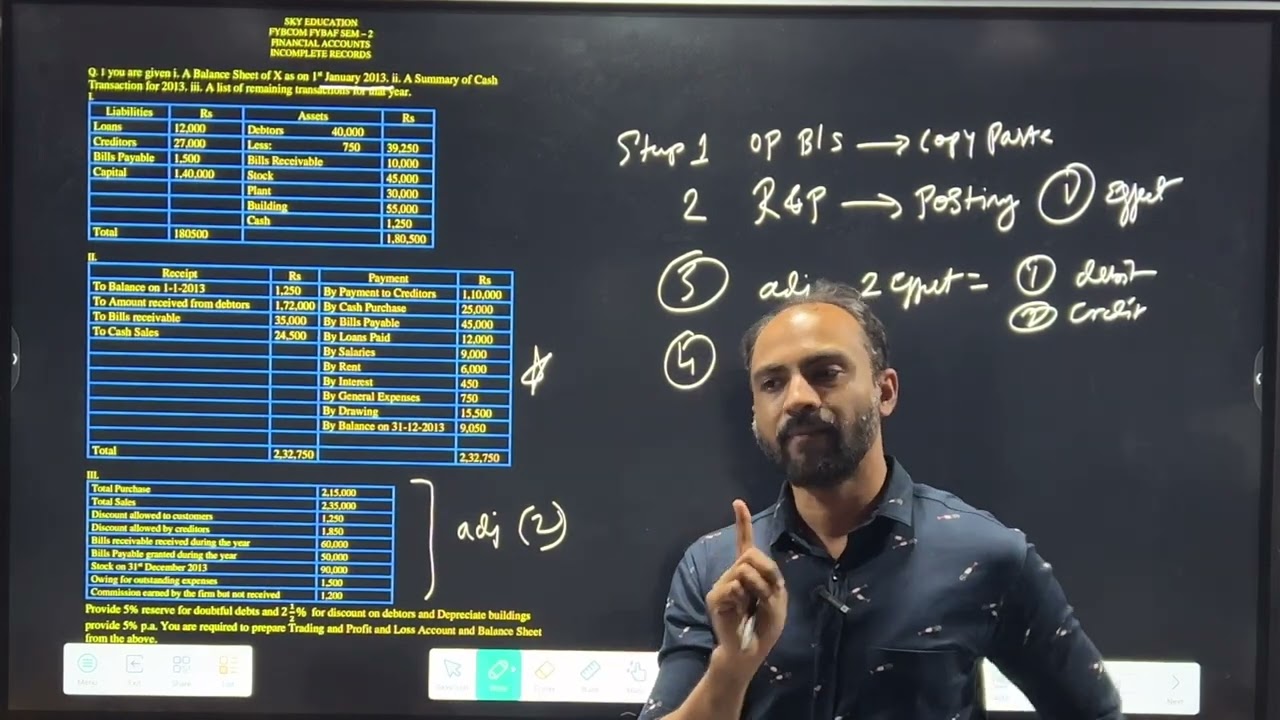

The presenter explains the structure of a typical question involving incomplete records. This usually includes a balance sheet (or information to create one) and a cash account, which may or may not be provided. The balance sheet includes assets (properties) and liabilities (debts). The approach involves using standard accounting formats like the trading and profit and loss account, which includes items such as opening stock, closing stock, purchases, and sales.

Formats for Balance Sheet and Working Accounts

The video outlines the formats needed to solve incomplete records questions. This includes preparing a balance sheet with items like capital, creditors, and closing stock. The capital section involves adjustments for drawings, profits, and losses. Additionally, the presenter mentions the importance of creating working accounts for Bills Receivable, Debtors, Bills Payable, and Creditors. These accounts help in organising and completing the missing information.

Steps to Solve Incomplete Records Questions

The presenter details the steps to solve incomplete records questions. The first step is to copy and paste the opening balance sheet if it is provided. If an account for an item exists (like Debtors or Creditors), the information is posted to that account; otherwise, it goes directly into the balance sheet. The second step involves posting receipts and payments, with each transaction having only one effect. Finally, the extra accounts are closed first, followed by the trading account, profit and loss account, and balancing the balance sheet.

Practical Example: Initial Balance Sheet Adjustments

The presenter begins working through a practical example, starting with copying the provided balance sheet information. Items like loans and capital are directly entered into the balance sheet, while items related to accounts like creditors and bills receivable are posted to their respective accounts. The presenter emphasises that liabilities are credited and assets are debited, explaining the rationale behind posting to the credit or debit side of the accounts.

Handling Receipts and Payments

The video explains how to handle receipts and payments in the context of incomplete records. Receipts can be either income or liabilities, while payments can be expenses or assets. Each receipt or payment has only one effect. For example, if cash is received from debtors, the cash account is debited, and the debtors account is credited. Similarly, payments to creditors involve crediting the cash account and debiting the creditors account.

Adjusting for Credit Purchases and Sales

The presenter explains how to adjust for credit purchases and sales. The total purchases are divided into cash and credit purchases. The credit purchases amount is then credited to the creditors account. Similarly, total sales are divided into cash and credit sales, with the credit sales amount debited to the debtors account.

Handling Discounts and Bills

The video explains how to account for discounts and bills. A discount received is credited in the profit and loss account and debited in the creditor's account. The presenter also explains the difference between Bills Receivable and Debtors, noting that Bills Receivable are essentially checks received from customers.

Closing Stock and Outstanding Expenses

The presenter explains how to account for closing stock and outstanding expenses. Closing stock is credited to the trading account and shown as an asset in the balance sheet. Outstanding expenses are added to the respective expense in the profit and loss account and shown as a liability in the balance sheet.

Depreciation and Bad Debts

The video explains how to account for depreciation and bad debts. Depreciation on buildings is debited in the profit and loss account and deducted from the value of the building in the balance sheet. Bad debts are calculated as a percentage of debtors, with the amount debited in the profit and loss account and deducted from debtors in the balance sheet.

Closing Accounts and Balancing the Balance Sheet

The presenter walks through the process of closing the various accounts, including Bills Payable, Creditors, Bills Receivable, and Debtors. The balances are then transferred to the balance sheet. Finally, the trading account and profit and loss accounts are closed to determine the net profit, which is then used to balance the balance sheet.