Brief Summary

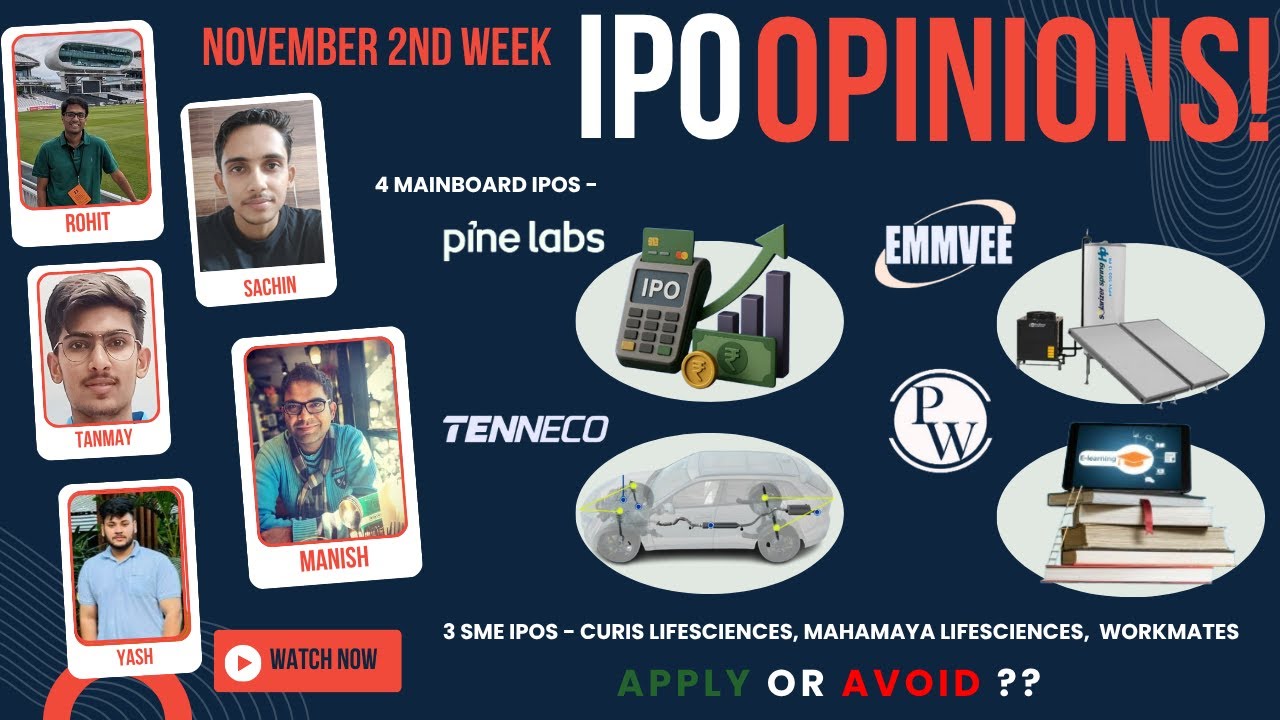

Alright, folks, this is a rundown of seven IPOs for the second week of November, brought to you by Sunday Investing. Remember, the market's choppy, so be extra careful with your applications. We're looking at company fundamentals, but do your own due diligence.

- Curis Lifesciences (SME): Pharma manufacturer, decent valuations but might not get high multiples.

- Workmates Core2Cloud (SME): IT solutions, explosive growth, but is it just another IT company?

- Mahamaya Lifesciences (SME): Agrochemicals, okay valuations, but keep in mind it's a cyclical business.

- Pine Labs (Mainboard): Fintech unicorn, reasonable valuation, but competition's heating up.

- Emmvee Photovoltaic (Mainboard): Solar PV module and cell manufacturer, good forward numbers, but industry derated.

- Physicswallah Ltd (Mainboard): Edtech company, phenomenal growth, but anchor book is just decent.

- Tenneco Clean Air India (Mainboard): Auto component manufacturer, reasonable valuation, but growth is a concern.

Opening Remarks

Namaste everyone, and welcome to Primary Market Chatter by Sunday Investing! Today, we're diving into seven companies with IPOs this week. But before we begin, a quick heads-up: IPOs aren't exactly the talk of the town right now, so keep the overall market sentiment in mind. This discussion is purely for informational purposes to understand the company's fundamentals. Please do your own research before investing. The market is quite unstable, so it's better to be cautious. Capital saved is capital earned, after all. Also, do follow the YouTube channel and Instagram for more updates, including a one-minute IP story and an IP interview for Workmates.

Curis Lifesciences (SME)

Curis Lifesciences, established in 2010, is a pharma company specializing in manufacturing and distributing pharmaceutical products globally and domestically. Their IPO is ₹27.5 crore, entirely a fresh issue. In FY25, they had a revenue of ₹50 crore. They operate in three verticals: loan licensing, contract manufacturing, and their own branded sales. They have a single facility certified by African health associations and WHMP. Tablets contribute a higher share to their revenues. They have clients in India and African nations and are targeting new regions like Myanmar and the Philippines. In FY23, they had ₹35 crore revenue with 6-7% EBITDA. Revenues remained flat in FY24 due to licensing issues. In FY25, revenues jumped to ₹49 crore with 19% EBITDA and 11% PAT. The IPO price is 16-17 times FY25 earnings. Anchor investors include Sani and Miq long fund. The speaker thinks it's decent on valuations and operations, but might not get higher multiples due to the nature of the work.

Workmates Core2Cloud (SME)

Workmates Core2Cloud, founded in 2018, is an AWS premier consulting partner known for cloud solutions across India. Their IPO is ₹20 crore, a fresh issue. FY25 revenue was ₹108 crore. The CEO, Kamill Naji, has a strong background, previously working with HCL and CFI Technologies. The company offers IT solutions across the life cycle. They are an AWS premium certified player, one of only eight in India. The management says their key to success is the skills they have inculcated in their team. They have seen explosive growth in the last 3 years. Management is guiding for 50% top-line growth over the next two years. Anchor investors include Invicta Continuum fund and Bharat fund. The speaker feels the IPO price of 19 times FY25 earnings is slightly expensive for an IT sector company.

Mahamaya Lifesciences (SME)

Mahamaya Life Sciences, established in 2002, specializes in manufacturing pesticide formations and supplying bulk products to Indian agrochemical companies and MNCs. The IPO is ₹70 crore, with ₹64 crore fresh issue. FY25 financials show ₹267 crore top line. They are research-driven, registering new molecules, which takes around five to six years per molecule. They source active ingredients mainly from China and Taiwan. Their client list includes top names like Cororumandel and Dhanuka Agritech. They have one facility in Gujarat and export to countries like Brazil, Turkey, and Egypt. B2B constitutes around 40-45% of revenues. They are targeting increased exposure to the Middle East and South America. They operate at almost 100% capacity. In FY25, they got a larger jump in revenue due to a good monsoon. The risk here is monsoon and active ingredients coming from China and Taiwan. The IPO price is near 16 times FY26 earnings. Anchor investors include Nav Capital, RT, and EBSU global opportunities fund.

Pine Labs (Mainboard)

Pine Labs, incorporated in 1998, is a leading Indian merchant commerce platform providing POS solutions, payment processing, and merchant financing services. The IPO is ₹3,900 crore, with ₹2,100 crore fresh issue. FY25 top line is ₹2,327 crore, with a loss of ₹145 crore. They facilitate transactions worth ₹11.4 lakh crore. Their services are used by 9.9 lakh merchants, 716 consumer brands, and 177 financial institutions. They are India's largest player in closed and semi-closed gift card issuances. 15% of revenues are from outside India. The company is raising ₹3,900 crore, out of which ₹2,080 crore is a fresh issue. They are repaying ₹532 crore worth of debt. Clients include SBI, HDFC, DMart, and McDonald's. The company doesn't have any promoters; it's professionally managed. PayPal owns around 4.5%, and Mastercard owns 4%. The speaker is not going to apply for listing gains.

Emmvee Photovoltaic (Mainboard)

Emmvee Photovoltaic Power, incorporated in 2007, is an integrated solar PV module and cell manufacturer. The IPO is ₹2,900 crore, with ₹2,100 crore fresh issue. They have a PV module capacity of 8 GW and a solar cell capacity of 3 GW. They are focusing majorly on Indian domestic operations. 97-98% of revenues are from B2B. They are ranked almost second to war energies. They are targeting around 16.3 GW of modules and around 9 G of cell capacity by FI28. In FI25, revenues grew to around ₹2,360 crore with 30% EBITDA and 15% PAT margin. They are saying they will grow around 35 to 40% CAGR every year from now on. The IPO pricing is near 40 times FI25 earnings. Anchor investors include Abid Abu fund, IC credential, SBI, and Franklin.

Physicswallah Ltd (Mainboard)

Physicswallah, incorporated in 2020, is an edtech company offering test preparation courses. The IPO is ₹3,500 crore, with ₹3,400 crore fresh issue. FY25 revenue is ₹3,000 crore. They have 13.7 million subscribers on YouTube. They operate around 300 offline centers. Their revenue is about 50/50 online versus offline. They have a massive paying subscriber base of 45 lakh people. They operate with a very low price point. They have a crazy community of almost 13 crore people across all of their social media channels. They are extremely outcome-focused. The team is also very impressive. The speaker thinks this is a very good company and might hold it for some time.

Tenneco Clean Air India (Mainboard)

Tenneco Clean Air India, established in 2018, is a part of Tenneco, a global leader in designing and manufacturing clean air and powertrain solutions. The IPO is ₹3,600 crore, all of which is OFS. They specialize in emission control systems, powertrain technologies, and performance solutions. Clients include Maruti Suzuki, Ford, and Nissan. They are India's largest supplier of clean air solutions with a 60% market share. In FY23, they corporated a revenue of ₹4,827 crores with an EBITDA of ₹571 crores. In FY25, the company revenue was ₹4,890 cr. The speaker feels small risk takers can bet for small listing gains.

Closing Remarks

So, there you have it – a quick look at seven IPOs. Thanks for tuning in, and we'll catch you on the weekend. The page will be up by tomorrow morning. Cheers, and bye!