Brief Summary

The video explains how business owners can legally minimize their tax payments by strategically structuring their businesses. It uses the example of a business owner named Marie, who transitions from a sole trader to a limited company and eventually incorporates a holding company to optimize her tax efficiency. The video covers strategies such as involving family members in the business, utilizing various tax allowances, and making pension contributions. It also touches on advanced strategies employed by the super-wealthy, such as borrowing against assets and using trusts for inheritance tax planning.

- Business structure significantly impacts tax liability.

- Transitioning from sole trader to a limited company can offer tax advantages as profits increase.

- Involving family members in the business can maximize tax-free allowances.

- Holding companies can be used to manage profits, invest in other ventures, and reduce overall tax burden.

Introduction

The video introduces the concept of legal tax minimization through strategic business structuring, highlighting that while rich people do pay taxes, they optimize their business structures to minimize their tax burden. The video aims to demonstrate how small business owners can implement similar strategies to retain more of their earnings. It emphasizes the importance of choosing the right business structure to avoid overpaying taxes and introduces the case study of Marie, a marketer transitioning to full-time consultancy.

Sole Trader vs. Limited Company

The video compares the tax implications of operating as a sole trader versus a limited company. As a sole trader, earnings are taxed at income tax rates (up to 45%) plus national insurance, with no legal separation between the individual and the business, potentially exposing personal assets to business liabilities. A limited company is a separate legal entity that pays corporation tax (19-25%) on its profits. Owners can then extract money through salary, dividends, or pension contributions, each with its own tax implications. Limited companies offer personal asset protection and greater control over tax planning.

Tax Planning with a Limited Company

The video discusses tax planning strategies using a limited company, noting that while the tax benefits might be marginal at lower profit levels (e.g., £40,000), they become significant as profits increase. Strategies include retaining profits within the company, utilizing dividends, and optimizing allowances, which are not typically available to sole traders. The video highlights that recent governmental changes have made tax planning more complex, requiring a combination of smart strategies rather than a single trick.

Maximizing Profits with Family Involvement

The video explores how involving family members in the business can reduce the overall tax burden. By employing Marie's husband and teenage children and paying them salaries, the family can utilize their individual tax-free personal allowances. This approach allows the company to claim these salaries as tax-deductible expenses, reducing the company's taxable profit. Dividends can then be split between Marie and her husband, who also owns shares in the company, further optimizing their tax position.

Everyday Deductions and Tax Exemptions

The video suggests utilizing smaller, everyday business deductions, such as company mobile phones and other business expenses, to further reduce the tax bill. By having the company cover expenses that the family already incurs, these expenses become tax-deductible for the company, and certain tax exemptions prevent the individuals from being taxed personally on these benefits.

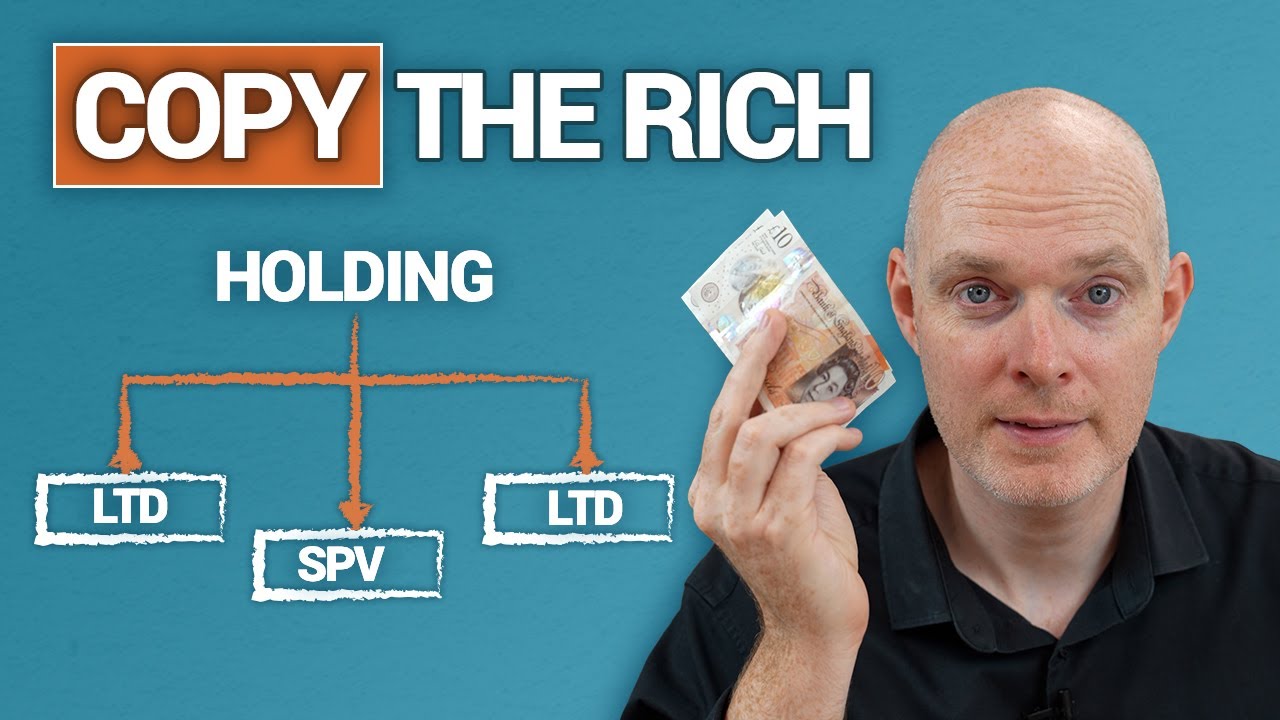

Introducing a Holding Company

The video introduces the concept of a holding company as a strategy for managing excess cash and further optimizing tax efficiency. Marie establishes a new holding company, jointly owned with her husband, which then owns her existing trading company. The trading company makes a £50,000 pension contribution for Marie, which is fully tax-deductible, saving the company £12,500 in corporation tax. The remaining profits are then paid to the holding company as dividends, which are effectively tax-free at this stage.

Investment and Expansion Strategies

The video details how the holding company can use its funds to invest in various ventures, such as property, through a special purpose vehicle (SPV), or a new business in a different sector. Profits from these ventures can then be paid up to the holding company as dividends. The holding company can also act as a management company, charging fees to its subsidiaries for central services, providing a tax deduction for the subsidiaries and potentially offsetting the holding company's tax liability with other deductions.

Tax Residency and Advanced Strategies

The video briefly touches on the topic of tax residency, noting that while some business owners may consider moving to countries with lower tax rates, the UK is still seen as a stable and desirable business environment. It also mentions advanced strategies used by the super-wealthy, such as borrowing against assets to access non-taxable cash and using trusts to protect wealth from inheritance tax.

Conclusion

The video concludes by emphasizing that tax-efficient structures are about paying only the right amount of tax, protecting personal assets, utilizing allowances, and planning for future growth. It reiterates that successful people do pay tax, but they use clever structures to lower the percentage of tax they pay relative to their income. The video suggests that business owners can start with simple structures like sole trading and scale towards more complex strategies as their businesses grow, potentially incorporating limited companies, SPVs, and holding companies.