Brief Summary

This video explains how to convert an effective interest rate to a nominal interest rate. It provides a step-by-step guide with examples for different compounding periods (monthly, quarterly, semi-annually, and daily). The key is to understand the formula and apply the correct order of operations, including taking roots and isolating the nominal interest rate variable.

- Converting effective interest rate to nominal interest rate.

- Step-by-step guide with examples.

- Different compounding periods (monthly, quarterly, semi-annually, and daily).

Introduction

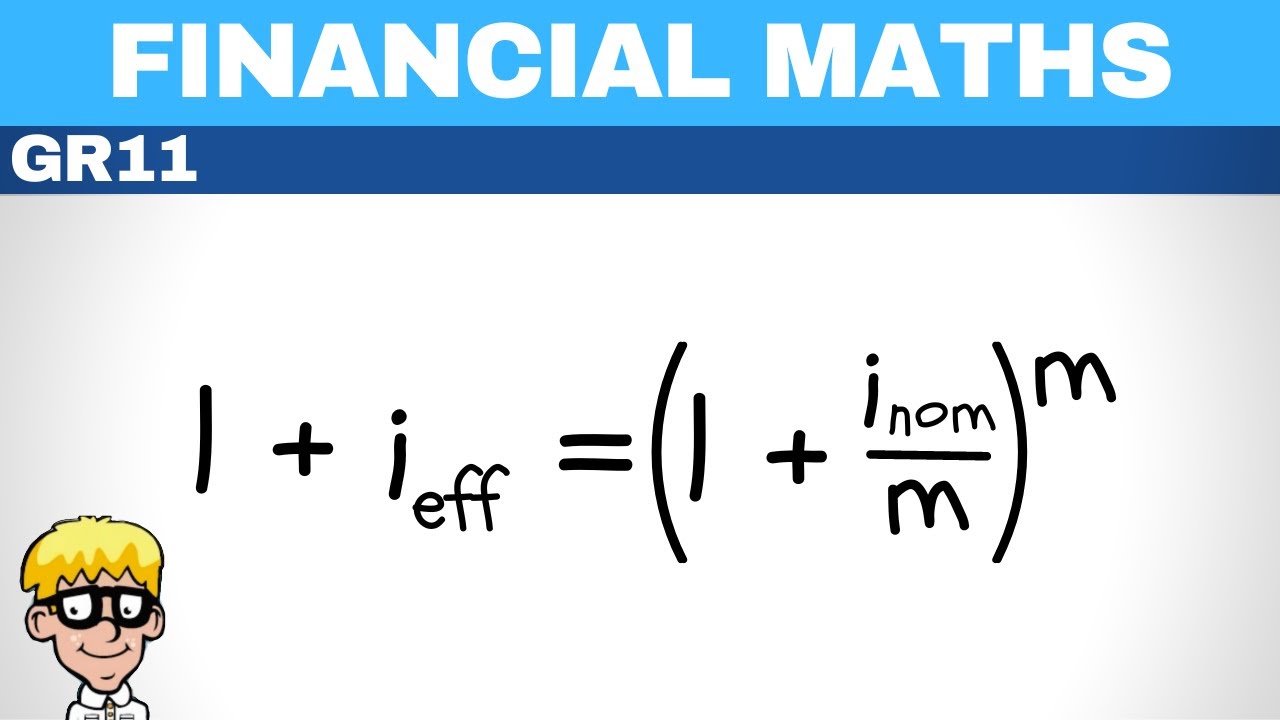

The video focuses on converting an effective interest rate to a nominal interest rate. The presenter emphasizes the importance of this skill in financial calculations.

Compounded Monthly

The presenter begins with an example where interest is compounded monthly. The effective interest rate is given as 7% (0.07). The goal is to find the nominal interest rate. The formula involves raising (1 + nominal rate/12) to the power of 12, which equals (1 + effective rate). To solve for the nominal rate, the presenter advises taking the 12th root of (1 + 0.07), subtracting 1, and then multiplying by 12. The calculated nominal interest rate is 6.78%.

Compounded Quarterly

Next, the presenter addresses a scenario with quarterly compounding. The effective interest rate remains at 7%. The setup involves using 4 as the compounding period. After performing similar calculations, the nominal interest rate is found to be 6.82%. The presenter shares a tip: the effective interest rate should always be slightly higher than the nominal interest rate.

Compounded Semi-Annually

The video proceeds to demonstrate the conversion when interest is compounded semi-annually. The effective interest rate is still 7%. The equation is set up with a compounding period of 2. The presenter walks through the steps: taking the square root of (1 + 0.07), subtracting 1, and multiplying by 2. The resulting nominal interest rate is 6.88%.

Compounded Daily

Lastly, the presenter tackles daily compounding. The effective interest rate is 7%. The compounding period is 365. The process involves taking the 365th root of (1 + 0.07), subtracting 1, and multiplying by 365. The nominal interest rate is calculated to be 6.77%.