Brief Summary

This video analyzes various charts and data to assess the market's current state and potential future trends. The author argues that the recent election results, combined with historical data, suggest a strong possibility of continued market growth in the coming years. However, he emphasizes the importance of maintaining realistic expectations and avoiding complacency, as market fluctuations are inevitable.

- The video highlights several charts and indicators that point towards a bullish market outlook, including the NASDAQ Composite, S&P 500, and Bitcoin.

- The author also discusses the importance of leadership in the market, noting that the NASDAQ is currently outperforming the Dow Jones Industrial Average.

- The video concludes by emphasizing the need for a flexible and open mind when analyzing market data and making investment decisions.

Post-Election Market Outlook: Bullish or Bearish?

The video begins by discussing the potential impact of the recent election results on the market. The author cites Yardeni Research, which suggests that the Republican sweep of the House and Senate could lead to a "roaring 2020s" scenario, with continued economic growth through the end of the decade and possibly into the 2030s. This aligns with the author's thesis that we are currently in a secular bull market driven by demographic factors, which could last until 2035.

Fed Rate Cut and Historical Data

The author then examines the recent Fed rate cut and its historical implications. He points out that the Fed has cut rates near all-time highs in the S&P 500 on 20 previous occasions, and in every case, stocks were higher a year later. The average gain a year later was 13.9%, with a median gain of just under 10%. While this historical data does not guarantee future performance, it suggests a higher probability of positive market outcomes in the coming year.

RSP vs. SPY: Leadership After Elections

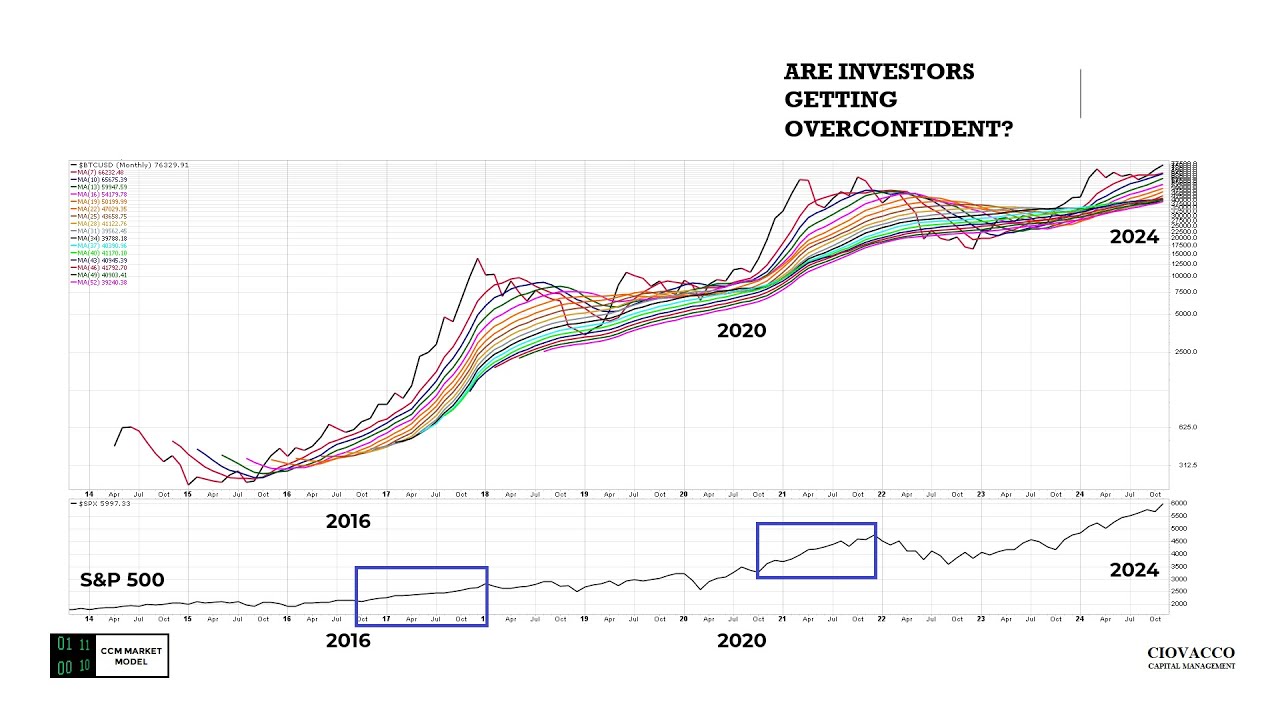

The video then analyzes the performance of the equal-weighted S&P 500 (RSP) relative to the standard-weighted S&P 500 (SPY) in the aftermath of the 2016 and 2024 elections. The author notes that in both cases, RSP outperformed SPY for a short period after the election, but then reverted to underperforming. This suggests that investors should not overreact to short-term movements in asset class behavior and leadership.

Chart Analysis: Looking for Bullish Breakouts

The author then examines several charts that he has used in previous videos to identify potential bullish breakouts. He analyzes the NASDAQ Composite, S&P 500, and Bitcoin, looking for patterns and indicators that suggest a continuation of the current market trend. He notes that several charts are showing signs of constructive momentum and bullish breakouts, suggesting a positive outlook for the market.

NASDAQ Composite: Momentum and Leadership

The video concludes with a detailed analysis of the NASDAQ Composite, highlighting its recent performance and potential for leadership in the market. The author notes that the NASDAQ is showing signs of improving momentum and is outperforming the S&P 500. He also discusses the importance of watching for a breakout above the July 2024 high, which would further solidify the NASDAQ's leadership position.

Disclaimer

The video ends with a disclaimer stating that the information presented is for informational purposes only and should not be construed as investment advice. The author emphasizes the importance of consulting with a licensed and qualified professional before making any investment decisions.